Do you know someone that actually likes taxes? A simple concept that turns out to be widely complex, and different everywhere you go. Moving to a new state is already difficult. Now add in the research you are currently doing to try and understand the new place you call home.

This includes different lifestyles, laws, and taxes. Texas is one of nine states that does not have a state income tax. Meaning the state of Texas does not set tax rates, collect taxes or settle disputes between you and local governments on property tax. Instead, taxes are collected at a local level, primarily through property tax.

Each city and school district within a county has slightly different tax rates. Homeowners in our Travisso community reside in the city of Leander. The tax examples below are based on Leander tax rates.

Property Tax in Travis County

Travis County residents pay several different taxes that are based off property value. These taxes are used to fund the city of Leander, school districts, city, hospitals, and local community colleges.

In total, taxes owed on a $400,000 home could be close to $10,000 for the fiscal year.

You can calculate your total taxes, based on location and exemptions, using this tax calculator from Travis County’s Tax Office.

Tax Distribution

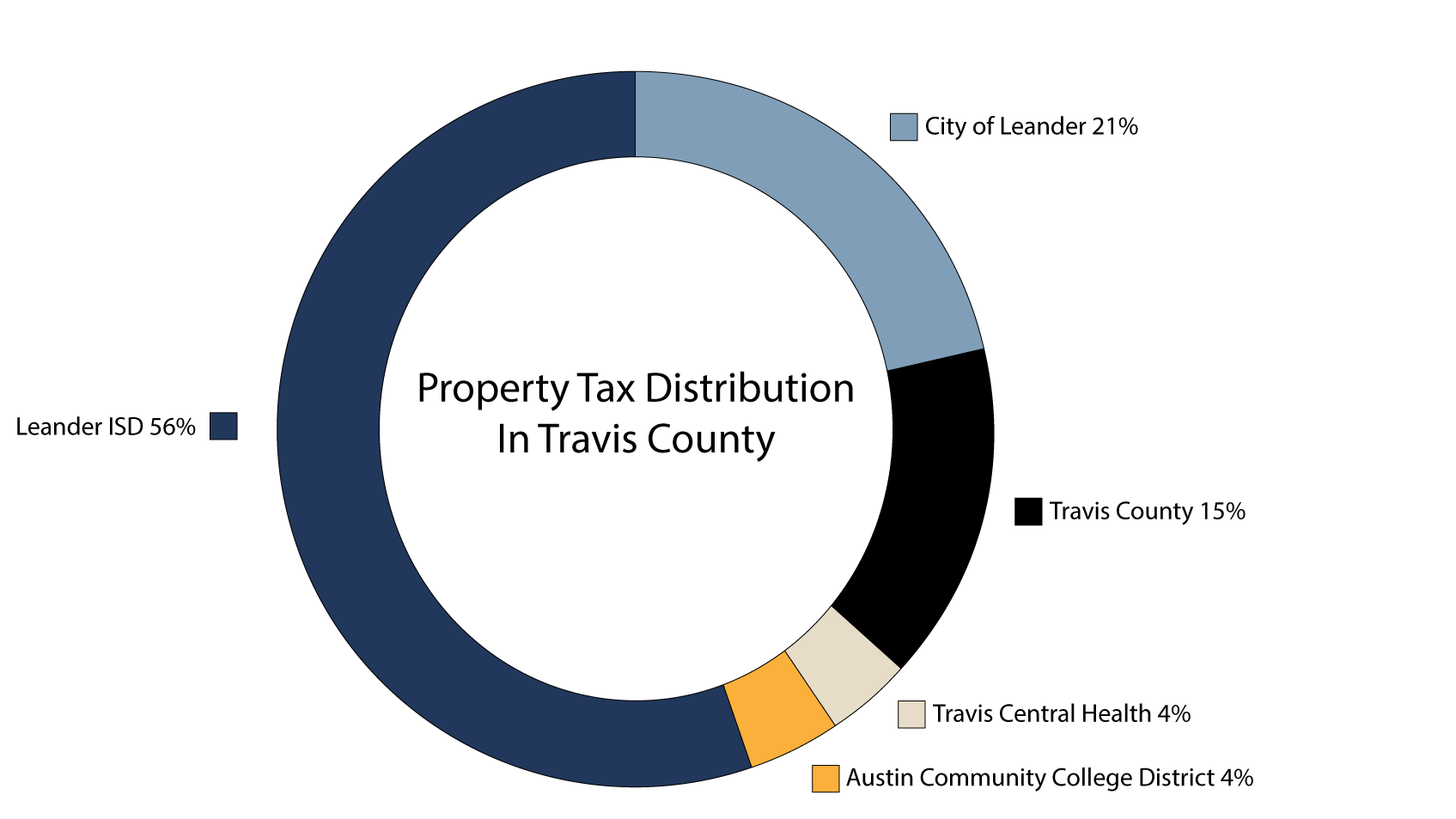

Once taxes are collected, the county distributes the funds. In most counties, a majority of your taxes are distributed to the schools, followed by the city budgets, and finally to county budgets.

For Leander Independent School District, the tax rate for the 2020-21 fiscal year is 1.4184%, equal to over half of the total taxes you could owe. The chart below breaks down an example of how total local property taxes could be distributed in Travis County.

You can expect to receive your tax bill around Oct. 1; however yearly property taxes are not due until Jan. 31 of the following year.

Living at Travisso

Moving to a new place is exciting. But, it can be easy to overlook the impact property taxes will have on your bottom line.

Now understanding the basic structure of taxes in Texas, you can start focusing on the fun part of homeownership, the experience of living in Travisso.

Explore more about the Travisso lifestyle and Leander area through our community guide.

Whether out of town or down the road, our community managers are eager to provide more information on our Travisso community.